The credit reporting agency, Experian recently came out with their annual “State of Credit Report,” which examines credit reports throughout the United States and uses that information to rank the cities and states with the highest and lowest credit scores.

Louisiana was one of the bottom 5 states for overall credit score average, and is home to 3 of the bottom 10 cities with the lowest credit scores: Monroe (635), Alexandria (636), and Shreveport (637).

The question is simple: Why do Louisiana residents struggle so desperately with credit?

The answer is a little more complicated

First, it is important to understand a little more about what a credit score is based upon.

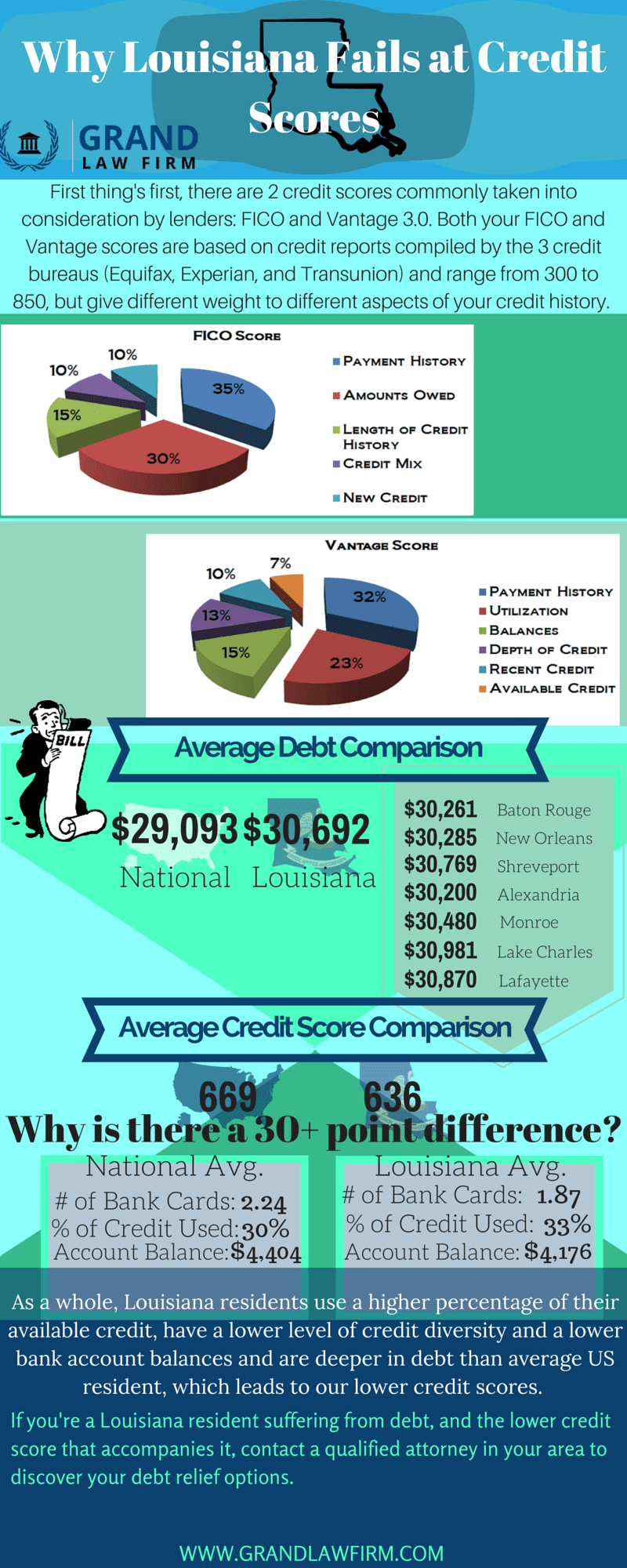

There are two types of credit scores that are commonly taken into consideration when someone applies for a line of credit: FICO and Vantage 3.0.

Both your FICO and Vantage 3.0 scores can range from 300 to 850 and are based on credit reports complied by the three US credit bureaus: Equifax, Experian, and Transunion. Though both your FICO and Vantage scores are based on similar aspects of your credit history, they give different weight to those different aspects.

Your FICO score is broken down in the following way:

35% Payment History

30% Amounts Owed

15% Length of Credit History

10% Credit Mix or Diversity of Credit

10% New Credit

While your Vantage score is broken down like this:

32% Payment History

23% Utilization of Credit

15% Account Balances

13% Depth of Credit

10% Recent Credit

7% Available Credit

Understanding how credit reporting companies determine your credit score can help you better understand how to improve your score in the future.

Now let’s talk about some numbers.

Experian reports that the nation average credit score is 669 while the average for Louisiana is only 636; but what causes that 30+ point gap? Louisiana residents have an average of 1.87 bank cards or checking accounts, which is lower than the national average of 2.24 cards/accounts. This lower level of credit diversity can, and often does, also results in a weak credit history because individuals have fewer connections with banks or other lines of credit. In addition to having slim credit diversity, Louisiana residents use an average of 33% of the credit available to them in comparison to the national average of 30%. Having fewer lines of credit and utilizing a higher percentage of the credit available to you lowers your credit score and can make it more difficult to find lenders when you need them.

Hopefully, this explanation has helped you better understand your Louisiana credit score and how to improve it in the future.

If you’re a Louisiana resident suffering for debt, and the lowered credit score that accompanies it, contact a qualifiedLouisiana debt relief attorney in your area to discover your debt relief options.