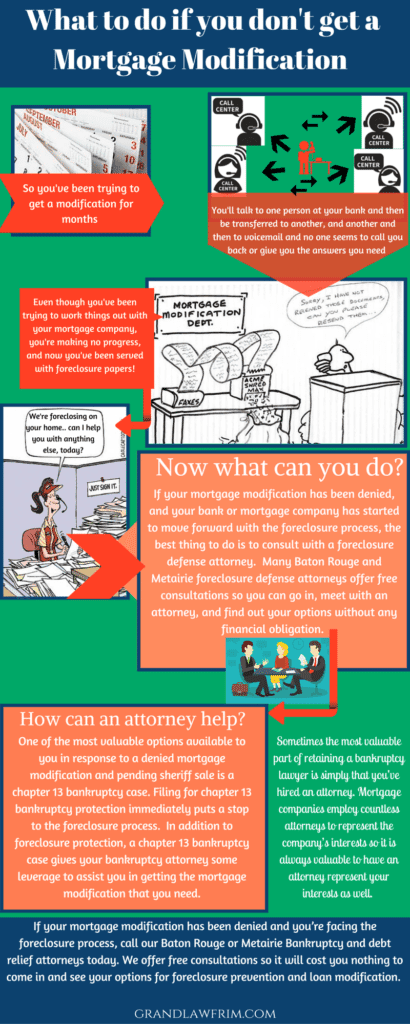

So you’ve been trying to get a mortgage modification for months.

You’ll talk to one person at your bank and then be transferred to

another and no one seems to call you back or give you the answers you

need but you just can’t afford to keep paying the original mortgage

amount. Even though you’ve been communicating with your mortgage

company you’ve made no real progress and they just served you with

foreclosure papers.

What do you do now?

If your mortgage modification has been denied, and your bank or mortgage company has started to move forward with the foreclosure process, the best thing to do is to consult with a foreclosure defense attorney. Many Baton Rouge and Metairie foreclosure defense attorneys offer free consultations so you can go in, meet with an attorney, and find out your options without any financial obligation.

What can an attorney do to assist you when your mortgage modification is denied?

One of the most valuable options available to you in response to a denied mortgage modification and pending sheriff sale is a chapter 13 bankruptcy case. Filing for chapter 13 bankruptcy protection immediately puts a stop to the foreclosure process. In addition to foreclosure protection, a chapter 13 bankruptcy case gives your bankruptcy attorney some leverage to assist you in getting the mortgage modification that you need.

Why would you consider hiring a bankruptcy attorney to stop your foreclosure and assist you in a mortgage modification?

Sometimes the most valuable part of retaining a bankruptcy lawyer to assist you in stopping of foreclosure is simply that you’ve hired an attorney. Mortgage companies employ countless attorneys to represent the company’s interests so it is always valuable to have an attorney represent your interests as well. Louisiana Bankruptcy and foreclosure prevention attorneys can leverage the law to assist you in staying in your home and negotiating with your mortgage company for more affordable monthly payments as well as establishing a reasonable re-payment plan for any arrearages that you accumulated while you tried to secure a modification on your own.

If your mortgage modification has been denied and you’re facing the foreclosure process, call our Baton Rouge or Metairie Bankruptcy and debt relief attorneys today. We offer free consultations so it will cost you nothing to come in and see your options for foreclosure prevention and loan modification.