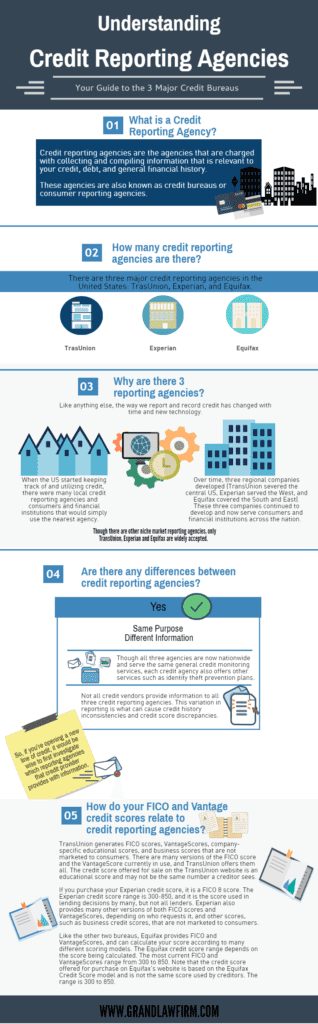

Understanding Credit Reporting Agencies:

We all know that credit scores are largely based on credit history, but who keeps track of that credit history? That’s where credit reporting agencies come into play.

What is a credit reporting agency?

Credit reporting agencies are the agencies that are charged with collecting and compiling information that is relevant to your credit, debt, and general financial history.

These agencies are also known as credit bureaus or consumer reporting agencies.

How many credit reporting agencies are in the US?

There are three major credit reporting agencies in the United States: TrasUnion, Experian, and Equifax.

Why are there three reporting agencies?

Like anything else, the way we report and record credit has changed with time and new technology. When the US started keeping track of and utilizing credit, there were many local credit reporting agencies and consumers and financial institutions that would simply use the nearest agency. Over time, three regional companies developed (TransUnion severed the central US, Experian served the West, and Equifax covered the South and East). These three companies continued to develop and now serve consumers and financial institutions across the nation. Though there are other niche market reporting agencies, only TransUnion, Experian and Equifax are widely accepted.

Are there any differences between credit reporting agencies?

Though all three agencies are now nationwide and serve the same general credit monitoring services, each credit agency also offers other services such as identity theft prevention plans. Additionally, it is important to note that not all credit vendors provide information to all three credit reporting agencies. This variation in reporting is what can cause credit history inconsistencies and credit score discrepancies. So, if you’re opening a new line of credit, it would be wise to first investigate which reporting agencies that credit provider provides with information.

How often can you request your credit report from a credit reporting agency?

The Fair Credit Reporting Act enables consumers to request one free credit report from each agency per year. You may request additional copies of your credit report from each agency, but you can expect to pay a fee for each report.

How do your FICO and Vantage credit scores relate to credit reporting agencies?

TransUnion generates FICO scores, VantageScores, company-specific educational scores, and business scores that are not marketed to consumers. There are many versions of the FICO score and the VantageScore currently in use, and TransUnion offers them all. The credit score offered for sale on the TransUnion website is an educational score and may not be the same number a creditor sees.

If you purchase your Experian credit score, it is a FICO 8 score. The Experian credit score range is 300-850, and it is the score used in lending decisions by many, but not all lenders. Experian also provides many other versions of both FICO scores and VantageScores, depending on who requests it, and other scores, such as business credit scores, that are not marketed to consumers.

Like the other two bureaus, Equifax provides FICO and VantageScores, and can calculate your score according to many different scoring models. The Equifax credit score range depends on the score being calculated. The most current FICO and VantageScores range from 300 to 850. Note that the credit score offered for purchase on Equifax’s website is based on the Equifax Credit Score model and is not the same score used by creditors. The range is 300 to 850.