The beginning of a New Year and ending of the holiday season is a time

for family, friends, joy, and checking the state of your financial affairs.

Did you just have a “one of those things is not like the others”

moment? It’s odd to think that family, friends, and finances go

hand in hand, but the truth is, they overlap more than one might expect.

Your finances are what allow you to provide for your family. The better

organized and financially sound you are, the more quality time you have

to spend with them now in addition to protecting them in the future. I

suggest a “State of the Union” session to plan ahead for the

coming year. You and your spouse or partner both need to know the financial

state of your household, and you both need to be on the same page going

into the new year. Please use this brief checklist as a jumpstart for

that discussion and planning session. There are a shocking number of websites

with savings, retirement, and budget calculators to help you through this

process, and even some apps to help you stay on course throughout the

year; but start with this checklist to ensure you have solid understanding

of your finances going into 2016.

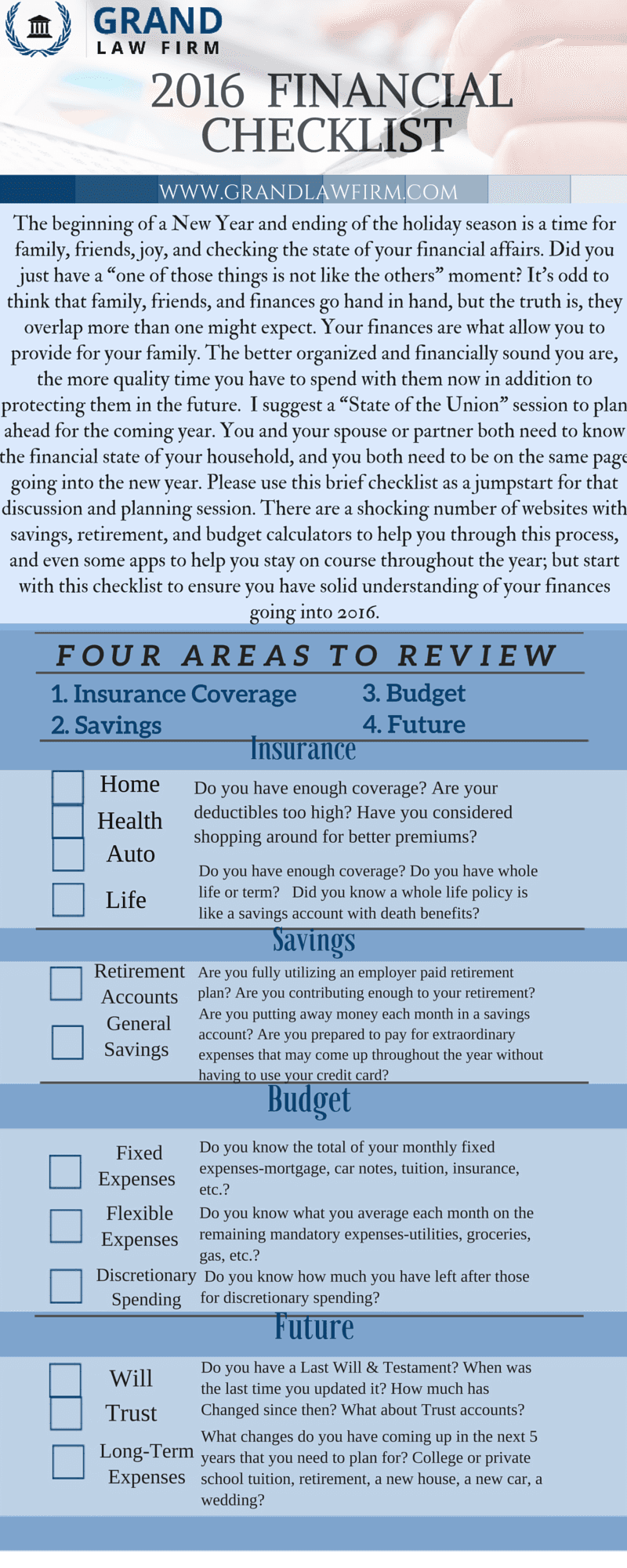

Four Areas to Review: Insurance, Savings, Budget, & Future.

1. Insurance

a. Home/Health/Auto- check your policies. Do you have enough coverage?

Are your deductibles too high? Have you considered shopping around for

better premiums?

b. Life- Do you have enough coverage? Do you have whole life or term coverage?

Did you know a whole life policy is like a savings account with death benefits?

2. Savings

a. Retirement-are you fully utilizing an employer paid retirement plan?

Are you contributing enough to your retirement?

b. Are you putting away money each month in a savings account? Are you

prepared to pay for extraordinary expenses that may come up throughout

the year without having to use your credit card?

3. Budget

a. Do you know the total of your monthly fixed expenses-mortgage, car notes,

tuition, insurance, etc.?

b. Do you know what you average each month on the remaining mandatory

expenses-utilities, groceries, gas, etc.?

c. Do you know how much you have left after those for discretionary spending?

4. Future

a. Do you have a will or trust?

b. What happens to your family if you die and your monthly income is not

there anymore?

c. What changes do you have coming up in the next 5 years that you need

to plan for? College or private school tuition, retirement, a new house,

a new car, a wedding?

Hopefully this will guide you to a more financially sound and less stressful 2016. Keep Grand Law Firm in mind for all your financial legal needs- Wills, Trusts, Successions, and even life insurance.

Have a happy 2016, everyone!