Prior to this reading this post on the chapter 7 Means Test exceptions, you may find it beneficial to read a general overview of the Means Test, available here.

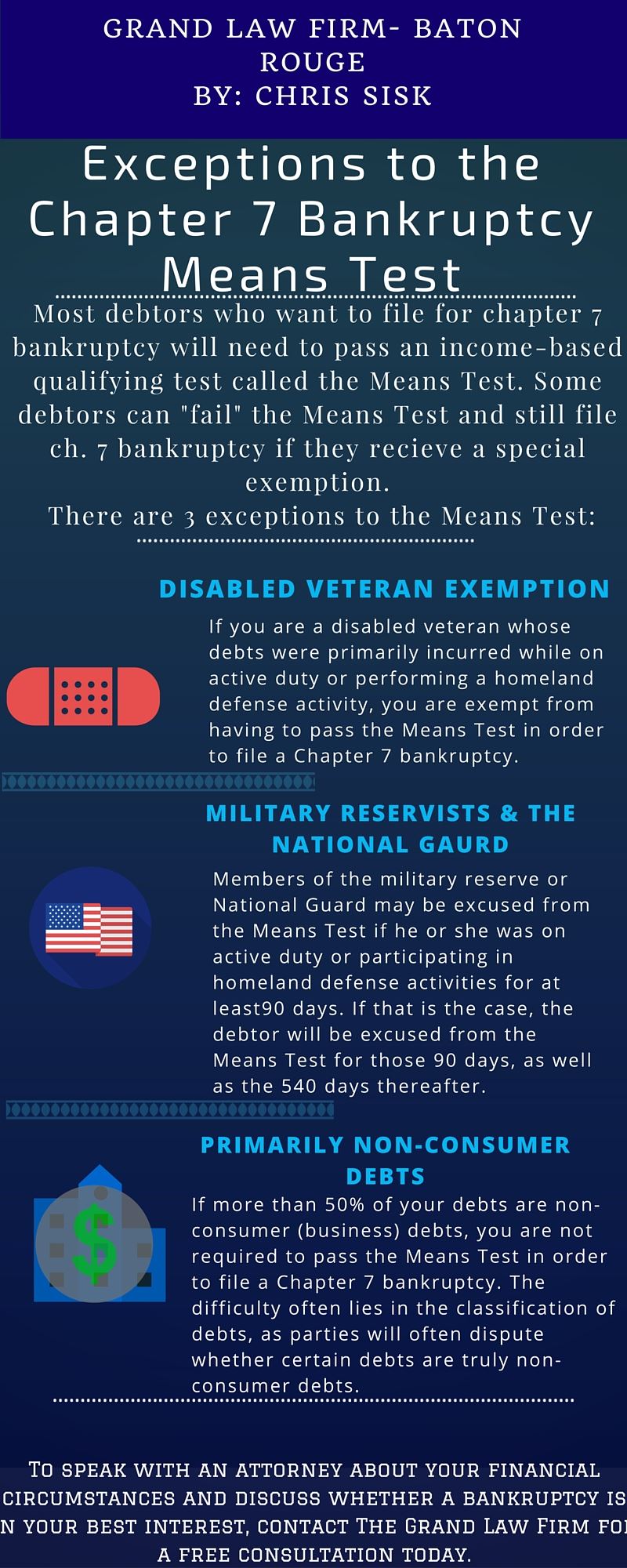

As detailed in a previous post, most debtors who want to file a Chapter 7 bankruptcy will need to pass an income-based test called the Means Test. As you may recall from that post, some Debtors who “fail” the Means Test may still file a Chapter 7 bankruptcy if they receive a special exemption, or waiver, from the chapter 7 Means Test. There are three exceptions to the Means Test, including an exception for disabled veterans, an exception for military reservists and the National Guard, as well as an exception for debtors whose debts are primarily non-consumer debts. In this post, we will discuss all three.

Disabled Veteran Exception

If you are a disabled veteran whose debts were primarily incurred while on active duty or performing a homeland defense activity, you are exempt from having to pass the Means Test in order to file a Chapter 7 bankruptcy.

In order to qualify as a disabled veteran under this exception, you must have a disability rating of at least 30%, and be discharged from active duty due to a disability that occurred in the line of duty.

Military Reservists & the National Guard

Members of the military reserve or National Guard may be excused from the Means Test if he or she was on active duty or participating in homeland defense activities for at least 90 days. If that is the case, the debtor will be excused from the Means Test for those 90 days, as well as the 540 days thereafter. It is important to note, however, that this exclusion period will end, and, if the time for objections to the Means Test qualification has not yet passed, you will be required to submit to the Means Test in order to receive a discharge under Chapter 7.

Having Primarily Non-Consumer Debts

Before discussing this exception, it is important to understand what a “non-consumer debt” is. Distinguishing a non-consumer, or business, debt from a consumer debt is important in a Chapter 7 bankruptcy, as having mostly non-consumer debts may lead to not having to pass the Means Test. Consumer debt is any debt that is owed as a result of purchasing goods that do not appreciate and cannot be consumed. A non-consumer debt is a debt that you incur with the objective of making a profit or for the benefit of a business.

When determining whether a specific debt is a consumer or non-consumer, it is often helpful to look at what the debtor did with the services received, as opposed to where the goods came from. For example, a personal guarantee made for the benefit of your business is often classified as a non-consumer debt.

As discussed in the post detailing a general overview of the Means Test, debtors must compare their annual income to the state’s median income, and then to eventually compare their income to the amount of debt that they have.

If more than 50% of your debts are non-consumer (business) debts, you are not required to pass the Means Test in order to file a Chapter 7 bankruptcy. The difficulty often lies in the classification of debts, as parties will often dispute whether certain debts are truly non-consumer debts.

To speak with an attorney about your financial circumstances and discuss whether a bankruptcy is in your best interest, contact The Grand Law Firm for a free consultation today.