What is the true cost of medical debt? Yes, there are bills that need to be paid but the stress of being hounded by creditors can take a much higher toll.

Millions of Americans are drowning in debt they accumulated due to a medical issue or illness.

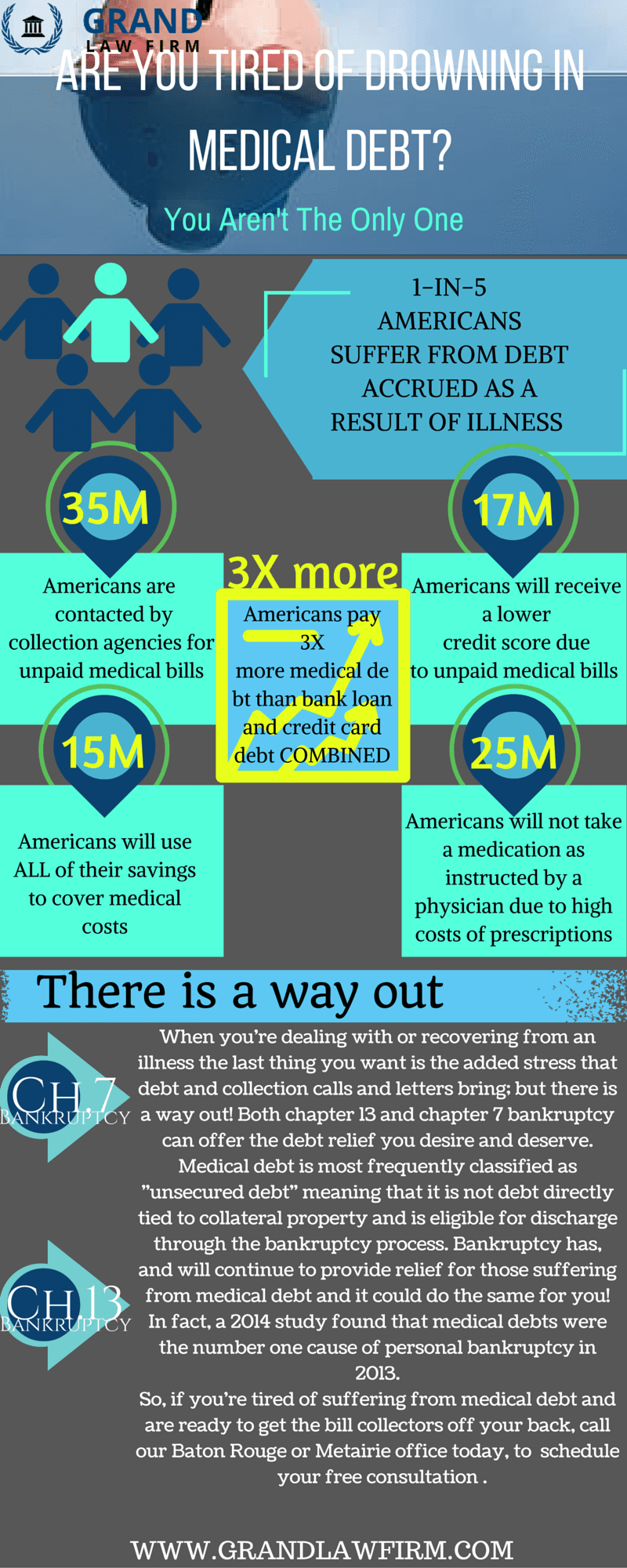

When you’re dealing with or recovering from an illness the last thing you want is the added stress that debt and collection calls bring; but there is a way out! Both Chapter 13 and Chapter 7 bankruptcy can often offer the medical debt relief you desire and deserve.

- 1 in 5 Americans suffer from debt accrued as a result of illness

- 35 Million Americans are contacted by collection agencies for unpaid medical bills

- 17 million Americans will receive a lower credit score due to unpaid medical debt

- 25 million Americans will not take medications properly due to their high cost

- 15 million Americans will use ALL of their savings to cover medical costs.

Medical debt is most frequently classified as “unsecured debt” meaning that it is not a debt directly tied to collateral property and is eligible for discharge through the bankruptcy process. If you qualify for a chapter 7 bankruptcy then you could be as little as 5 months away from the medical debt relief you deserve!

Bankruptcy has, and will continue to provide medical debt for millions of Americans and it could do the same for you! In fact, a 2014 study found that medical debts were the number one cause of personal bankruptcy in 2013.

So, if you’re tired of suffering from medical debt and are ready to get the bill collectors off your back, call our office today at (504) 608-5208, and schedule your free consultation to discover how bankruptcy can help alleviate medical debt.

Other Sources: